1For qualified contracts, the maximum length of time for the Period Certain options may be less than 10 years, if necessary to comply with RMD regulations for annuities stipulated in the Setting Every Community Up for Retirement Enhancement (SECURE) Act.

2Not available with a QLAC.

3All Joint Life options require that the joint annuitant be a spouse.

4Not available on qualified contracts.

Insurance product and rider guarantees, including optional benefits and any fixed crediting rates or annuity payout rates, are backed by the financial strength and claims-paying ability of the issuing insurance company. They are not backed by the independent third party from which this annuity is purchased, including the broker/dealer, by the insurance agency from which this annuity is purchased, or any affiliates of those entities, and none makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company.

Broker/dealer and state variations may apply. Contact your broker/dealer for availability.

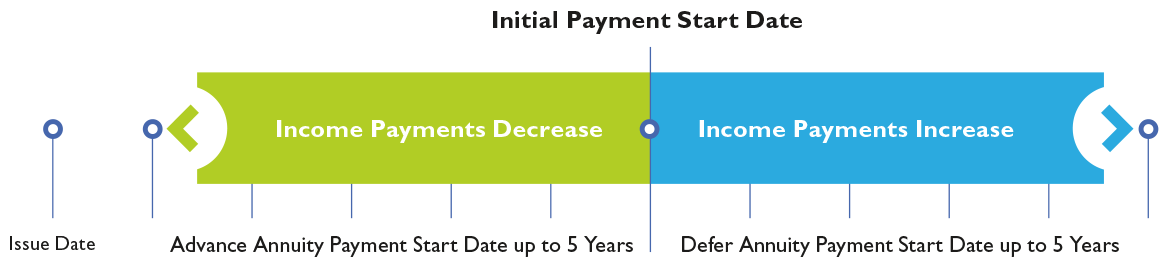

Qualified contracts, including traditional IRAs and Roth IRAs, are eligible for favorable tax treatment under the Internal Revenue Code (IRC). Certain payout options and certain product features may not comply with various requirements for qualified contracts, which include required minimum distributions and substantially equal periodic payments under IRC Section 72(t). Therefore, certain product features, including the ability to change the annuity payment start date and to exercise withdrawal features, may not be available or may have additional restrictions.

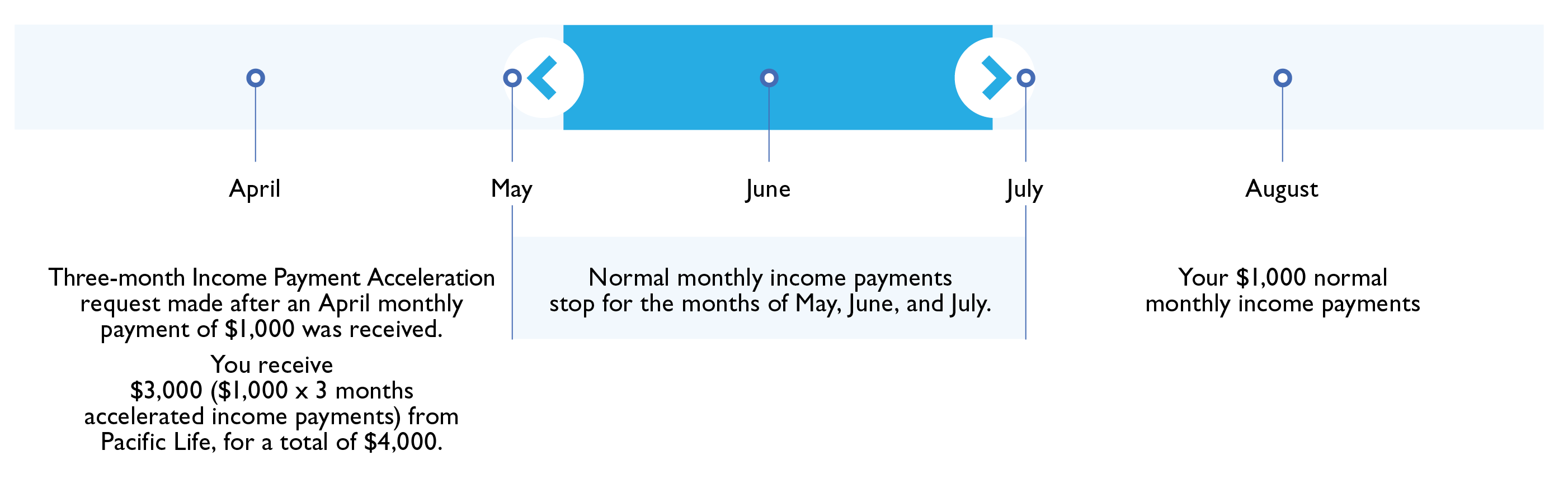

Pacific Secure Income can be used as a qualified longevity annuity contract (QLAC), subject to state and firm availability. For the contract to be eligible as a QLAC, certain requirements under Treasury Regulations must be met, including limits on the total amount of purchase payments that can be made to the contract. Compliance with the QLAC purchase payments limit is the owner’s responsibility, and failure to adhere may result in the contract no longer being considered a QLAC, and would subject the value of the QLAC to required minimum distribution requirements that may not be accessible through the contract. In addition, there are restrictions on annuity payout options that can be elected under a QLAC contract, and the commutation, payment acceleration, and inflation protection features are not available. Changes to marital status may require a change to the annuity payout option and/or payments in order to maintain the QLAC status.

For Roth IRAs, upon the Roth IRA owner's death, distributions to the beneficiaries may be subject to the required minimum distribution rules. If the designated beneficiary is not the spouse, the beneficiary may be required to take a lump-sum payment of the present value of the guaranteed payments if a death benefit becomes available. The five-year waiting period for qualified Roth distributions still applies to payments made after the death of the Roth IRA’s owner. Any required minimum distribution taken by the beneficiary within this five-year waiting period may be taxable.

Contracts may be subject to an additional 10% federal income tax for annuity payments, withdrawals, and other distributions prior to age 59½. For nonqualified contracts, an additional 3.8% federal tax may apply on net investment income.

Contract Form Series: 30-1294, 30-1305NJ Rider Series: 20-1300, 20-1299 Endorsement: ICC 15:15-1400 State variations to contract form series, rider series, and endorsements may apply.