Deciding When to Claim Benefits

Putting things off until tomorrow is not usually a recommended course of action, unless you’re talking about Social Security. The longer your clients delay the start of their Social Security retirement benefit (up to age 70), the larger their monthly check will be.

There are three options for claiming Social Security retirement benefits:

-

At Age 62

Social Security checks will equal 70%-75% of the client’s full retirement benefit.

-

At Full Retirement Age (FRA)

Checks will equal 100% of the client’s full retirement benefit.

-

After Full Retirement Age (FRA)

There is an 8% credit per year for waiting, up until age 70. At that point, the check can equal up to 132% of the client’s full retirement benefit.

Every Client Is Unique

While delaying Social Security benefits is a strategy many clients use to increase the amount they receive each month, it’s not for everyone. Each client’s individual situation should be considered before making a decision. Some reasons for not delaying include:

- Poor health

- Forced retirement

- Employer downsizing

- Reduced life expectancy

- Inability to meet essential expenses without Social Security income

The chart below shows how to determine each client’s FRA, which is the time at which they will be eligible for their full retirement benefit.

| Year of Birth* | FRA |

|---|---|

1943-1954 |

66 |

1955 |

66 and 2 months |

1956 |

66 and 4 months |

1957 |

66 and 6 months |

1958 |

66 and 8 months |

1959 |

66 and 10 months |

1960 or later |

67 |

* If born on January 1 of any year, refer to the previous year

Source: Normal Retirement Age. Office of the Chief Actuary, Social Security Administration, October 2017.

What Delaying Benefits Could Mean to Your Clients

Let’s look at an example of how delaying benefits could affect a couple’s income. We’ll assume:

-

FRA for both spouses: Age 66

-

Husband's benefit at FRA: $2,000/month

-

Wife's benefit at FRA: $1,000/month

Note: When a spouse dies, the surviving spouse inherits the larger of the two retirement benefits.

Example:

| Age |

Action Taken |

Monthly Benefit | |

|---|---|---|---|

| Wife | Husband | ||

| 62 | Claim at 62 | $750 | $1,500 |

| 66 | Wait until FRA | $1,000 | $2,000 |

| 70 | Capture delayed retirement credit | $1,320 or $2,640 if husband dies and he delayed benefits until age 70 | $2,640 |

Total difference in combined benefits by delaying until age 70 instead of starting at age 62: $1,710/month or $20,520/year

Who May Benefit Most

While delaying Social Security benefits can help a wide range of clients increase their monthly retirement income, there are two types of people who may have a special incentive for delaying.

Married Couples

Married couples often have a greater chance than a single person of benefitting from delaying Social Security. This is because the number of Social Security payments received depends on the lives of both spouses.

Additionally, many wives outlive their husbands, and most widows receive their husband’s higher monthly benefits in place of their own. If the husband takes benefits early, it will permanently reduce the payments not only to the him (while he’s alive) but to his widow after he dies. Delaying benefits may be a way to secure a higher survivor benefit for the wife.

Individuals with Long Life Expectancies

Individuals with long life expectancies may receive a more significant advantage from delaying. This is because Social Security calculates the reductions and increases to payments so that, regardless of when individuals begin benefits, they will have received the same amount of money at the time they reach their average life expectancy. Living beyond average life expectancy results in income that exceeds the amount calculated by Social Security.

Taking Benefits While Receiving Other Income

There are special incentives for delaying Social Security income until or past FRA if a client is still working.

-

Taxation of Benefits—Up to 85% of the client’s Social Security benefits may be included in income and subject to income tax. That may affect your client’s total taxable income. Currently, about one-third of people who receive Social Security must pay taxes on their benefits. It’s wise to consult with a tax advisor for the most current information.

-

Earnings that Exceed Certain Limits—If a client begins benefits while working and before reaching his or her FRA, and earnings exceed certain limits while they work, some or all of the Social Security benefits will not be paid right away. Instead, social security will recalculate the client’s benefit amount after FRA to give credit for any months in which they did not receive benefits due to earnings. This may increase their benefit amount. Again, it’s important to check with a tax advisor to understand the current earnings limits.

An Alternate Strategy for Working Clients

Clients who are employed may want to consider supplementing their working income with Roth IRA withdrawals instead of taking Social Security benefits.

- Contributions to a Roth IRA can be withdrawn anytime, tax free, and are not subject to the 10% additional federal tax on early distributions.

- Earnings from a Roth IRA are generally tax-free and not subject to the 10% additional federal tax on early distributions if the client is at least age 59½ and has owned the account for at least five years.

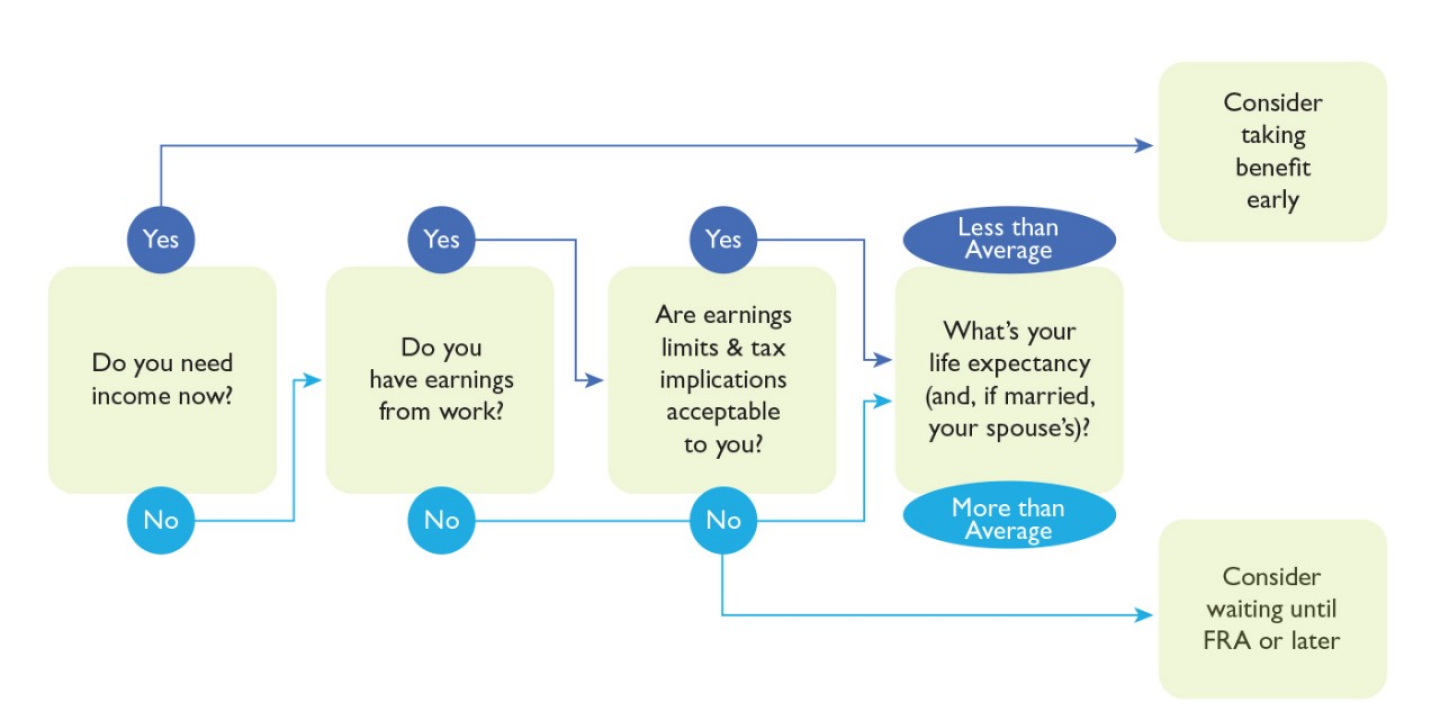

As clients decide when to begin their Social Security retirement benefits, they may want to refer to this helpful decision tree, which sums up many of the important considerations reviewed above:

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current law, which is subject to change at any time. Clients should consult with their accounting or tax professional for guidance regarding their specific financial situations.

A Social Security Decision Tree