Harnessing the power of tax deferral can give clients a big savings boost over time. But, many investors overlook tax strategies as part of their planning processes. Tax-deferred investments, such as annuities, take advantage of tax-free growth. Earnings are reinvested, and your clients' money compounds over time, potentially offering stronger long-term outcomes than taxable accounts.

The Power of Tax Deferral

Rules to Remember

Harnessing the power of tax deferral can give clients a big savings boost over time. But, many investors overlook tax strategies as part of their planning processes. Tax-deferred investments, such as annuities, take advantage of tax-free growth. Earnings are reinvested, and your clients' money compounds over time, potentially offering stronger long-term outcomes than taxable accounts.

The Rule of 72

If clients’ assets are in a tax‑deferred vehicle such as an annuity, they can use the “Rule of 72” to estimate how long it might take to double their money.

Estimated years to double one’s money:

72 ÷ Expected growth rate

Example:

A tax-deferred annuity growing at 4% would double in about 18 years

(72 ÷ 4 = 18).

The Rule of 96

If clients' assets are in a taxable account, the "Rule of 96" can be used to estimate the time needed for that money to double, assuming a 24% federal income-tax rate assessed yearly on the taxable investments and an expected growth rate. Taxes are subtracted from the earnings each year, which increases the time it takes for the account value to double. See the table for examples.

The Rule of 108

The “Rule of 108” estimates the time needed for clients' taxable assets to double, assuming a 32% federal income-tax rate assessed yearly on the taxable investments and an expected growth rate. Taxes are subtracted from the earnings each year, which increases the time it takes for the account value to double. See the table for examples.

The Rules in Action

Below are examples of these rules using expected growth rates between 3% to 7%. Use the tool with clients to determine the amount of time it would take for their savings to double in value in a tax-deferred account.

How Long Could It Take Clients to Double Their Savings?

| Expected Growth Rate |

The Rule of 72 (Tax-Deferred) | The Rule of 96 (Taxable at 24%) | The Rule of 108 (Taxable at 32%) |

|---|---|---|---|

| 3% |

24 Years | 32 Years | 36 Years |

| 4% | 18 Years | 24 Years | 27 Years |

| 5% | 14 Years | 19 Years | 22 Years |

| 6% | 12 Years | 16 Years | 18 Years |

| 7% | 10 Years | 14 Years | 15 Years |

For illustrative purposes only. There is no guarantee the expected growth rate can be achieved. Not intended to predict performance or demonstrate results for any product offered by Pacific Life. Some numbers above have been rounded to the nearest whole number. The Rule of 72, Rule of 96, and Rule of 108 are mathematical concepts and are not illustrative of any products offered by Pacific Life.

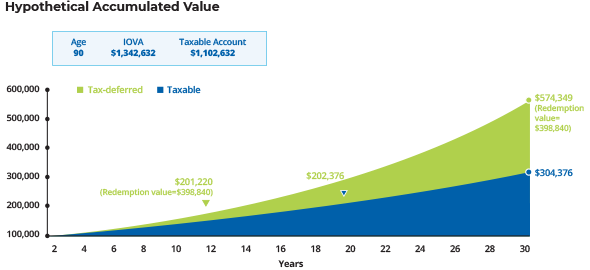

Demonstrate the Long-Term Value of Tax Deferral

Show clients the impact of tax deferral in all phases of their retirement journeys.

Want to Talk Further on This Topic?

The Retirement Strategies Group, subject-matter specialists with advanced degrees and designations such as CFA®, CFP®, ChFC®, CLU®, and JD, are ready to help.

Call: (800) 722-2333 or (800) 748-6907 in New York | Email: RSG@PacificLife.com

VLP2718-0722H-1

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. Clients should consult with their accounting or tax professionals for guidance regarding their specific financial situations.

All investing involves risk, including the possible loss of the principal amount invested.

Under current law, a nonqualified annuity that is owned by an individual is generally entitled to tax deferral. IRAs and qualified plans—such as 401(k)s and 403(b)s—are already tax-deferred. Therefore, a deferred annuity should be used only to fund an IRA or qualified plan to benefit from the annuity's features other than tax deferral. These include lifetime income, death benefit options, and the ability to transfer among investment options without sales or withdrawal charges.