Source: Bloomberg

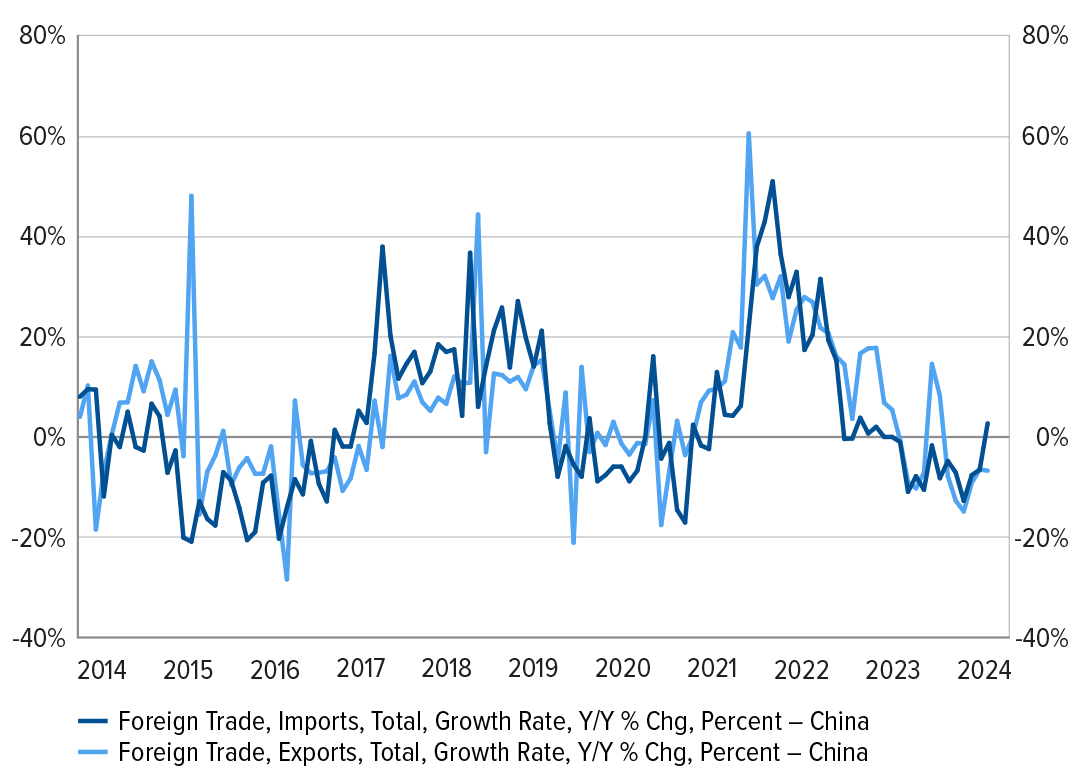

Related to the confidence issue is the unfavorable sentiment on Chinese equity. The low sentiment is attributed not only to economic concerns but also to geopolitical risks, as tensions between nations, trade disputes, and political instability can significantly influence investment sentiment. With the 2024 U.S. and Taiwan elections approaching, geopolitical risks may remain elevated or even escalate. The current leading candidate in the Taiwanese election supports Taiwan’s independence, a red line for Beijing. While a war in Taiwan is not the base case, the risk is not zero, and the potential damage to emerging markets and the global economy could be substantial.

Government’s Recent Economic Policies

The recent Central Economic Work Conference (CEWC)— a pivotal government meeting on economic matters— reflects heightened concerns about the economic landscape. Despite a pro-growth stance symbolized by phrases like “growing to stabilize” and “building before breaking,” policymakers did not advocate for stimulus targeted to consumers, which is urgently needed. Instead, the emphasis is on supporting the mitigation of downside risks, ensuring a measured recovery, and maintaining growth quality over speed primarily through industrial policies.

The central government also reconfirmed its recent commitment to expedite local government debt restructuring, specifically refinancing. A housing rescue package with explicit support pledged for developers’ reasonable funding needs is currently in the works. The CEWC aims to actively address risks in the property sector and accelerate social housing construction, but the success of this initiative will hinge on the size and structure of the package.

While specific numeric targets for GDP growth and fiscal deficit remain elusive, signals suggest a potentially high growth target of “around 5%” and an on-budget deficit ratio exceeding 3%. The CEWC, in line with recent practices, defers these details to the National People’s Congress in March.

These polices are encouraging, but we don’t predict them to be game changers for the Chinese economy or equity markets. A catalyst is still yet to be found.

Conclusion

Deciding whether to overweight or underweight emerging markets equity requires a nuanced analysis of various factors. Given China’s substantial weight in the emerging markets equity index, investors must closely monitor China’s recent developments and its long-term challenges. At present, there is no clear resolution to the numerous issues China faces—particularly those of a more prolonged and secular nature. Despite the current cheap valuation, it is prudent to avoid overweighting emerging markets equity due to the prevailing uncertainties and challenges in China. It may be wise to wait patiently for a major catalyst.

PLFA Process

Within Pacific Life Fund Advisors (PLFA), we incorporate our quantitative and qualitative approach to investing. Market participants and observers are presented with new data points on a continuous basis. As we further analyze these data points, we will implement them into our process as appropriate. PLFA continues to properly gauge leading indicators to ensure our portfolios are properly aligned with our views.