Market Review

With the futures market anticipating more rate easing from the Federal Reserve (Fed), equity markets shot sharply higher throughout the third quarter of 2025 with the S&P 500® index up 8.12% for the quarter. The positive sentiment favored small-cap stocks, especially small-cap value (encompassing many regional banks that benefit from a steepening yield curve). International markets underperformed domestic markets, as the MSCI EAFE Index gained only 4.77%.

Within fixed income, long-duration bonds outperformed their shorter-duration counterparts, as the yield on 10-year Treasury bonds fell during the quarter. Optimism also spread throughout the credit space with emerging markets debt and high yield delivering positive gains and outperforming the Bloomberg Barclays U.S. Aggregate Bond Index for the quarter.

Outlook

Revived optimism heading into the second half of 2025 jolted the U.S. equity market to record levels. Despite prolonged geopolitical conflicts as well as uncertainties of fiscal and monetary policies, risk assets maintained upward momentum. Economic data, political developments, and Fed communications contributed to the quick market recovery. Furthermore, corporate earnings remained more stable than many analysts had anticipated, as inflation remained relatively stable and has yet to show through official economic reports.

Based on gross domestic product (GDP) growth—a lagging indicator—the U.S. economy has shown stable growth in recent quarters. While many companies have been freezing new hiring activity (likely due to the lack of clarity on global trade as well as domestic and international politics), we have not yet observed any concerning signs of intensifying mass layoffs despite the number of news headlines covering layoffs at prominent companies. Further supporting the U.S. economy, the Fed initiated its easing cycle by cutting the fed fund rate by 25 basis points to the 4.00–4.25% range in September. Market expectations of more rate cuts in late October and December have amped up risk-taking activity. However, if the Fed votes to pause in October and/or December, market volatility will likely reemerge and intensify.

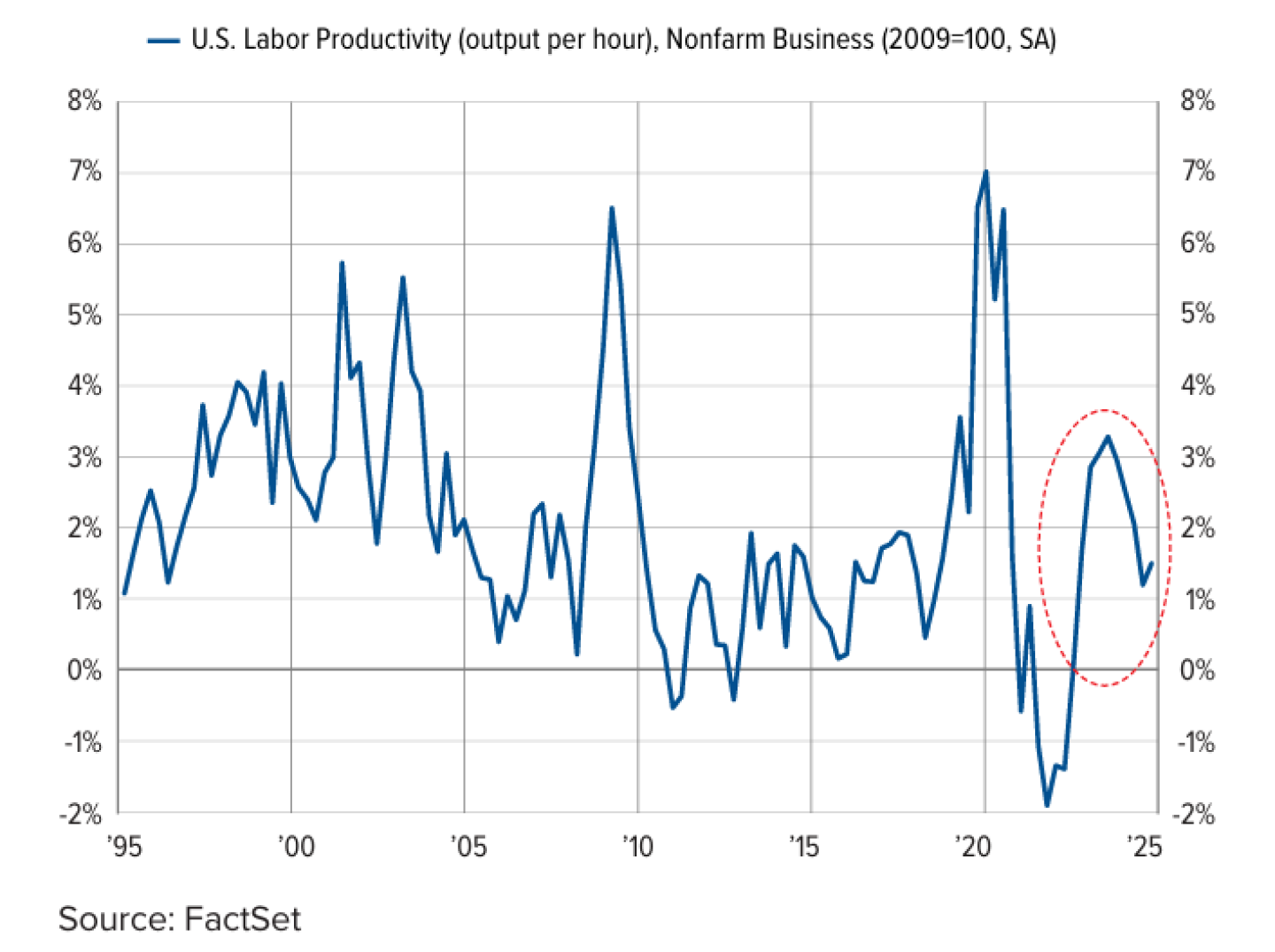

Additional rate cuts should provide relief for borrowers and should help offset the negative effects of the tariffs. So far, corporate earnings have largely exceeded expectations, aided by disciplined expense management and improved productivity.

Technology, utilities, and industrial sectors have been benefiting from the renewed interest and increased spending on developing infrastructure to support artificial intelligence (AI). However, this widespread interest in AI has led to some extremely elevated valuations in certain growth-oriented companies. This merits selective investing as well as balancing between alpha generation and risk management. This could also mean investors may place more emphasis on quality, as defined by companies with strong balance sheets, stable cash flows, and pricing power.

International markets continue to remain mixed. Economic recovery in Europe has been uneven, as weak manufacturing continues to weigh on consumer sentiment. Meanwhile, Asian economies have been more balanced. China’s stimulative policy measures may be starting to show some stabilization, although consumer and corporate confidences remain fragile. On the other hand, shifting supply chains have boosted economic growth in India and Southeast Asia, as these regions are unleashing their long-term structural advantages and potential. Similar to domestic equities, managing international exposures also will require balancing between alpha opportunities and portfolio risk.

Fixed-income markets have become more relevant after years of suppressed yields below 3%. The yields on the 10-year Treasury bonds have generally stabilized and have ranged between 4–5% in recent quarters, offering decent yields and defensive characteristics. Furthermore, spread products such as high-yield bonds still offer attractive carry as long as the economy remains healthy and maintains low default rates.