Equity markets started positively but declined midway through the first quarter of 2025, with the S&P 500® index down –4.27% for the quarter (and roughly –9.00% between mid-February and end of March), ending the streak of positive quarters. Growth stocks materially underperformed value stocks during the quarter. The potential impacts of President Trump’s aggressive tariff policies encouraged many investors to sell out of cyclical sectors and seek shelter in safer defensive sectors. On the other hand, international stock indexes (both developed and emerging markets) realized positive gains, which were primarily driven by the weakening dollar during the first quarter. Nonetheless, international equities likely will be negatively affected by Trump’s tariffs, which will impact the economies of the targeted foreign nations.

Within fixed income, long-duration bonds outperformed their shorter-duration counterparts, as the yield on the 10-year Treasury fell during the quarter. Despite some volatility in the domestic equity market, credit-spread sectors—including emerging-markets debt, bank loans, and high-yield bonds—produced positive returns but underperformed core bonds.

Outlook

Animal spirits lifted equity markets higher during the first half of first-quarter 2025, but consumer sentiments veered toward uncertainty and fear during the end of the quarter. After the 2024 presidential and U.S. Congress elections, Republicans assumed full control of the White House and both sides of the U.S. Congress. The unified government under the Republican party offered an opportunity for Trump to easily push through his policies and agenda. The result, especially from a shifting tariff policy, has been uncertainty in domestic and international markets and, with it, flights to safety.

While many question whether these actions will lead to a recession or stagflation, the U.S. economy has a small buffer, which may give Trump a window for some success. Trump claims that his goal is to negotiate better trading terms and/or reshore some manufacturing back to the U.S. However, achieving Trump’s full demands are likely impossible due to many factors. For instance, if the increased tariffs are implemented for a prolonged period, that could fundamentally change our growth forecast, heightening the chances of gross domestic product (GDP), consumption, and earnings to turn negative during the second half of this year.

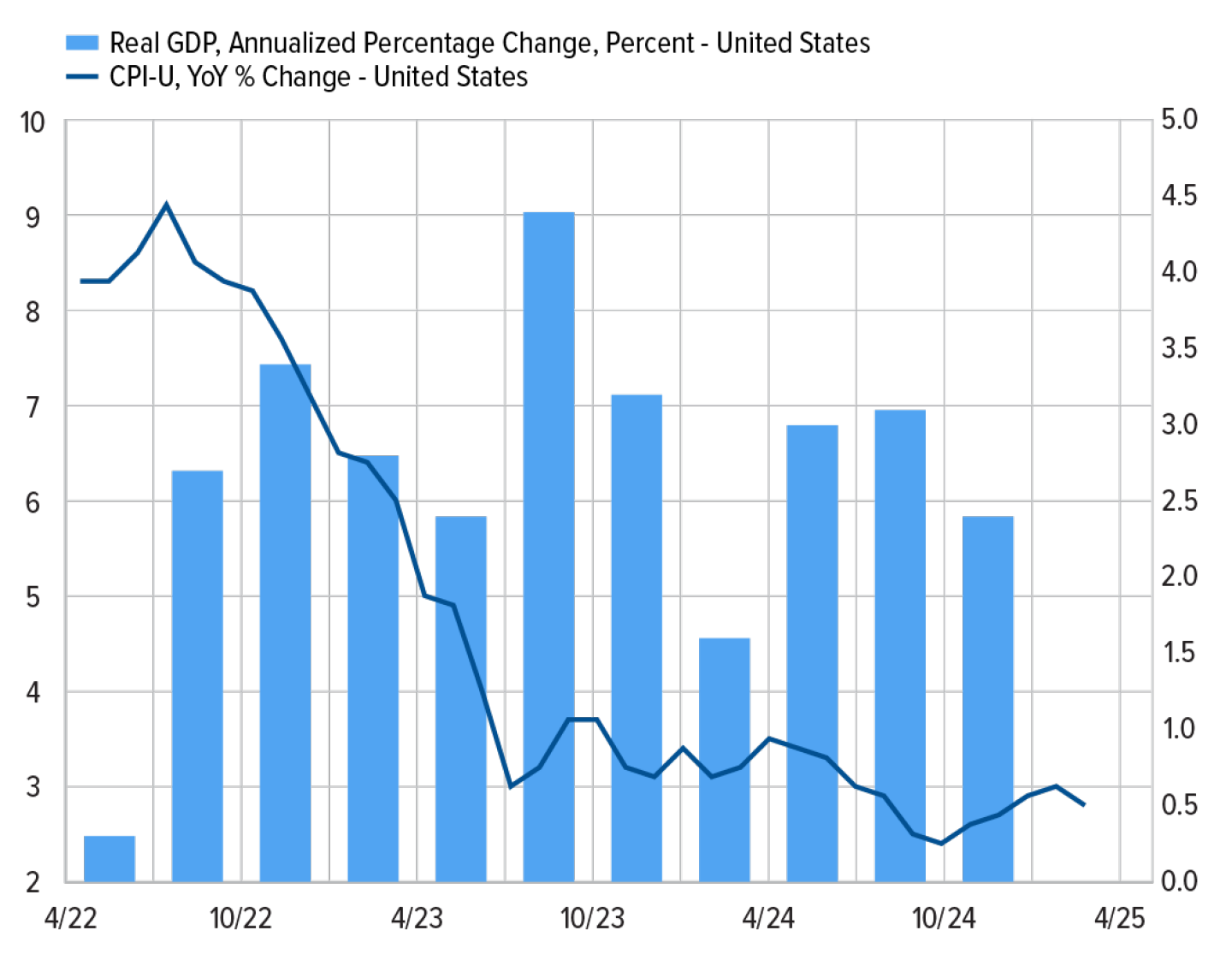

For now, U.S. economic growth remains stable, and inflation is slowly stabilizing.

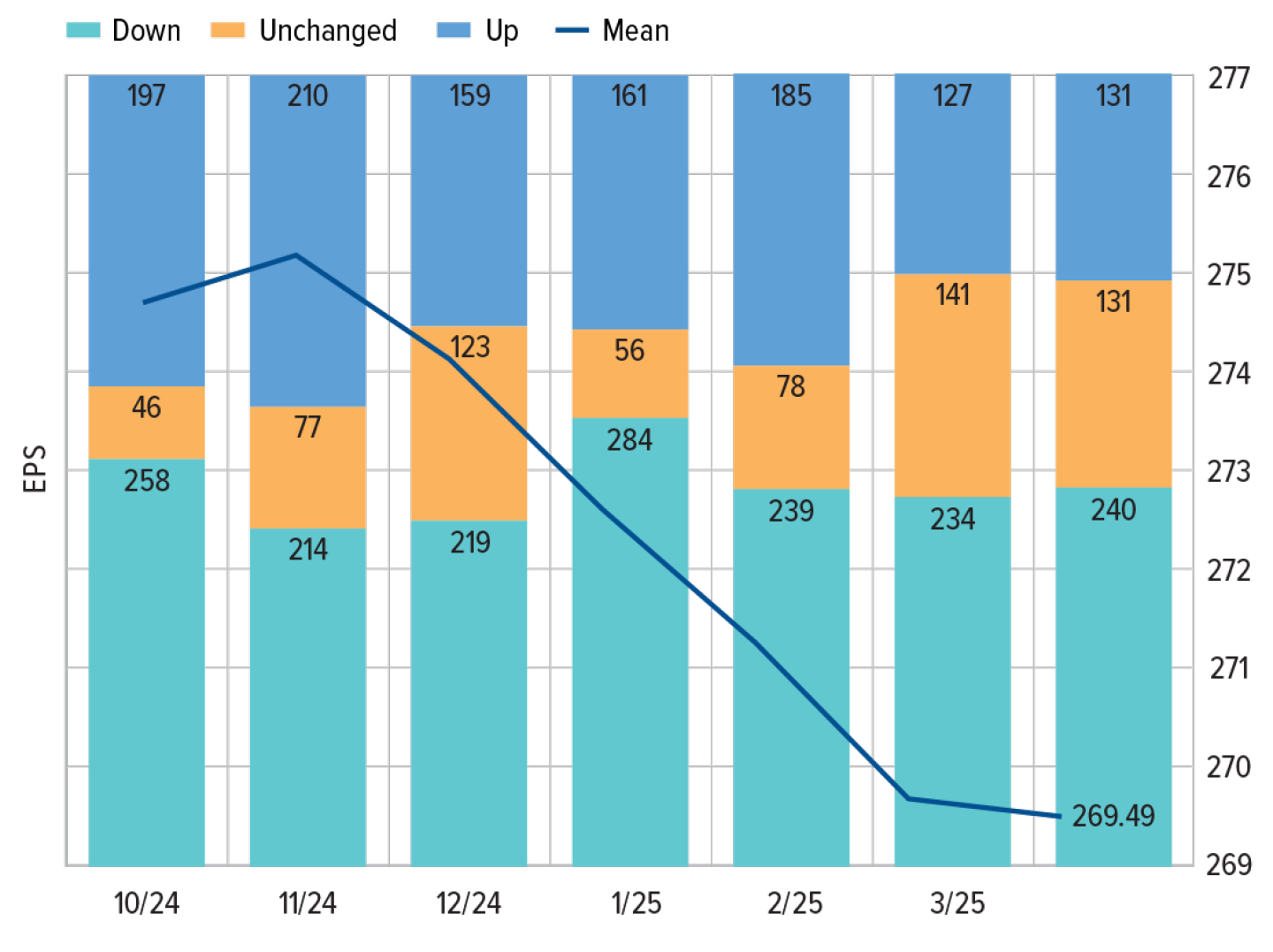

The positive economic momentum may have convinced Trump’s supporters to initially accept what the President believes are protectionist weapons. However, a prolonged trade war has the potential to knock the economy and markets off course. So far, U.S. consumers have been resilient, but business leaders will have to make difficult choices when these import taxes increase producer prices and start squeezing profits. Companies will eventually need to: pass costs onto consumers (driving inflation upward); cut expenses, including employees; lower earnings projections; or deploy a combination of these negative outcomes. In fact, Wall Street analysts have continually lowered 2025 year-end earnings projections for S&P 500 companies since Trump was elected in November 2024.