Market Review

Equity markets bounced higher during the fourth quarter of 2023, with the S&P 500® index up 11.69% for the period as market breadth widened, benefiting recently out-of-favor styles. In terms of size and style, small-cap value performed well after struggling during the prior few quarters. Among domestic equities, large-cap value lagged other styles. Real estate, which had struggled throughout the year, also performed well during the final quarter of 2023. Consistent with much of 2023, international equities continued to lag domestic stocks, particularly as Chinese stocks continued to face multiple challenges.

Within fixed income, longer-duration bonds outperformed their shorter-duration counterparts, as the yield on the 10-year Treasury plunged during the quarter. Among the credit-spread sectors, emerging-markets debt and high yield performed relatively well, while bank loans struggled to keep pace.

Outlook

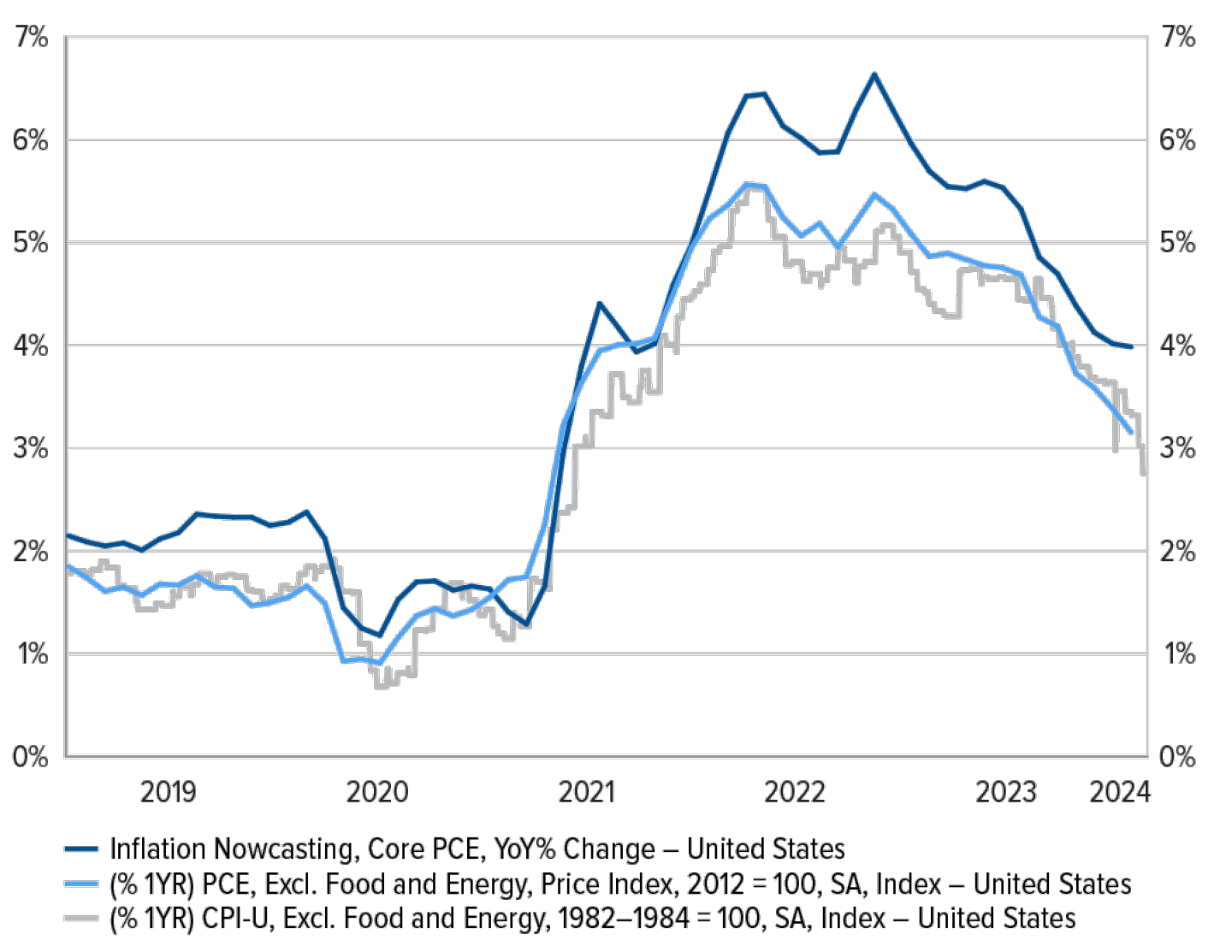

The Federal Reserve (Fed) paused rate hikes during the last three Federal Open Market Committee (FOMC) meetings of the year. Unless inflation pressures resurface, the Fed is likely finished with its rate- hike cycle. At the time of this commentary, the market consensus suggests that the Fed will pursue interest-rate cuts sooner rather than later, with the first cut coming as early as March 2024. However, this view is based on core inflation heading toward the Fed’s target of 2% during the next several months.