Equity markets made further gains during the second quarter of 2024 with the S&P 500® index up 4.28% as large tech companies continued to lead the market. In terms of size and style, large-cap growth stocks performed well as companies like NVIDIA continued to report strong earnings. Among domestic equities, small-cap value lagged other styles with the sentiment for regional banks remaining challenged. Developed international equities continued to lag behind domestic stocks, although emerging markets faired relatively well during the quarter despite persistent hurdles in China. Positive growth in Taiwan and India helped offset the slowdown in China.

Within fixed income, short-duration bonds outperformed their longer-duration counterparts as the yield on the 10-year Treasury bounced higher during the quarter. Among credit spread sectors, bank loans, emerging-markets debt, and high-yield all performed relatively well versus core bonds.

Outlook

While inflation in the U.S. continues to decelerate slowly toward the Federal Reserve’s (Fed’s) target rate of 2%, its sluggish progress (despite a cooling labor market) has delayed interest-rate cuts. Heading into the year, markets had predicted the Fed would have begun cutting rates by now, but fear of reigniting inflation has convinced the Fed not to make changes during the first half of 2024.

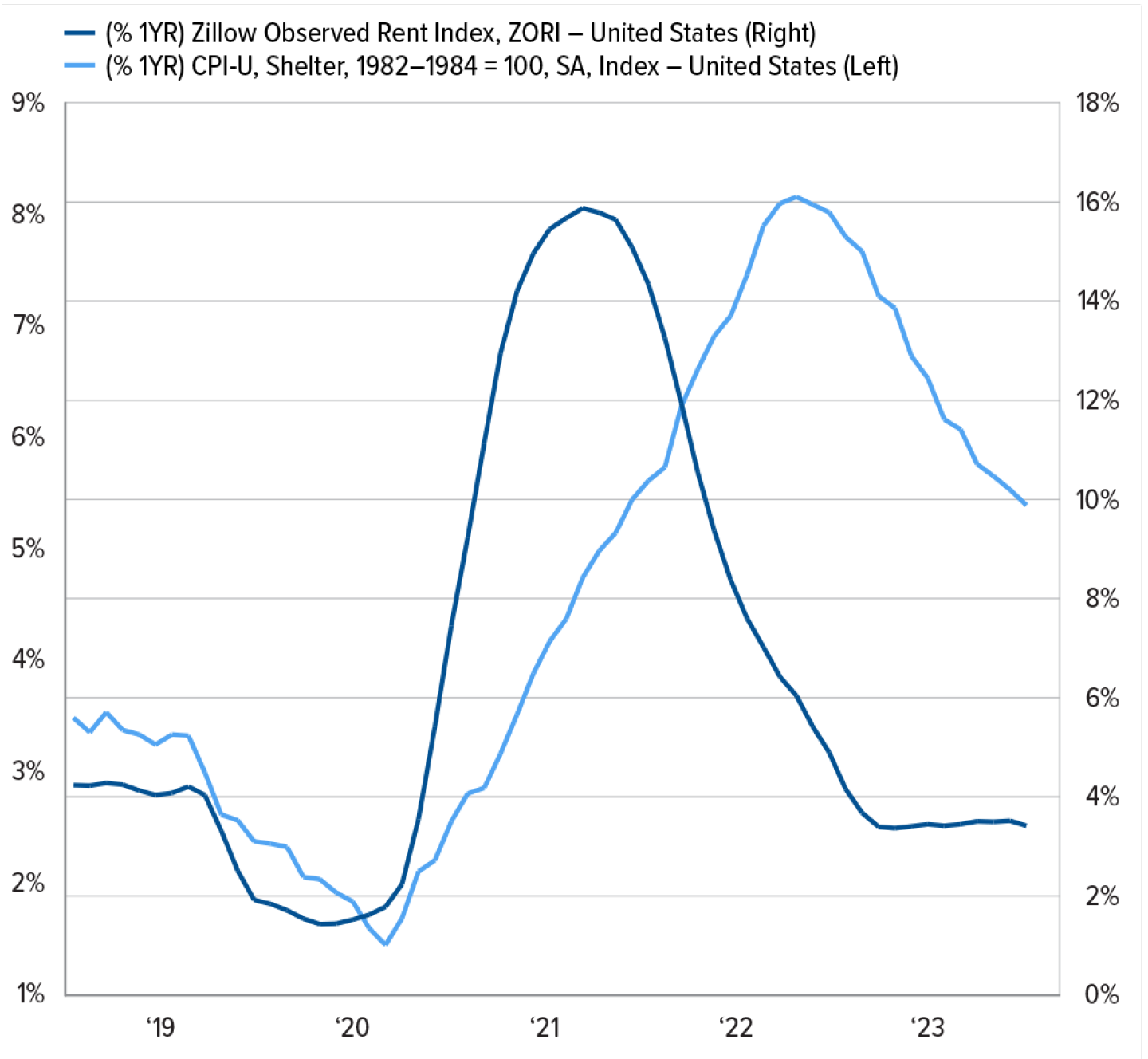

As anticipated, Consumer Price Index (CPI)–Shelter (which represents about a third of overall CPI) continues to decelerate—albeit remaining relatively high. Given the method the Bureau of Labor Statistics uses to calculate shelter inflation, this official data tends to lag market data by several quarters. This trailing effect is illustrated by the following chart, which compares CPI shelter and Zillow’s rent index.