Market Review

Equity markets shot sharply higher throughout the second quarter of 2025, with the S&P 500® Index up 10.94% for the quarter after President Trump delayed the implementation of reciprocal tariffs. Large- and mid-growth stocks led the domestic equity group, while real estate and small-value stocks lagged the broader market. The weakening U.S. dollar was a tailwind for foreign stocks, which also returned double-digit gains. With the threat of tariffs temporarily sidelined, foreign small cap stocks performed particularly well.

Within fixed income, long-duration bonds underperformed their shorter-duration counterparts, as the yield for the 10-year Treasury trended higher over the quarter. Optimism also spread throughout the credit space with bank loans, emerging market debt, and high yield bonds delivering positive gains for the quarter.

Outlook

Valuations and fundamentals seem to have had minimal influence over the market throughout the first half of 2025. Geopolitics typically have transitory market impacts; however, the recent situation calls for closer examination due to the spontaneity of Trump’s policy efforts. For instance, the announcement of reciprocal tariffs surprised the market, and the S&P 500 Index tumbled roughly 12% in just a week. Nonetheless, this drop proved temporary after the Trump administration rescinded his reciprocal tariffs, postponing the implementation for 90 days. Since then, the market quickly recovered those initial losses, ending the second quarter with double-digit gains.

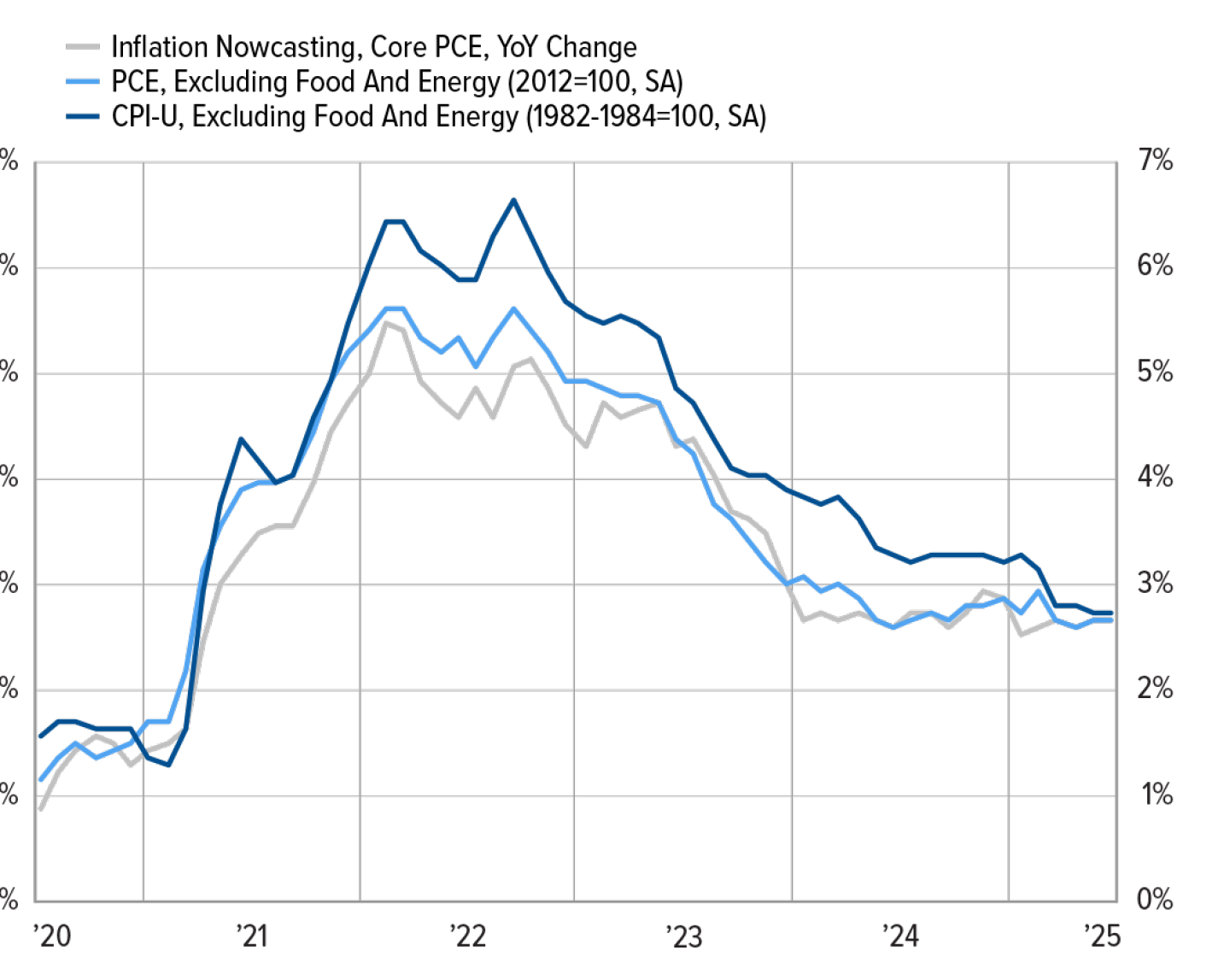

Further adding to the positive momentum, the One Big Beautiful Bill Act of 2025 squeezed through the U.S. Congress, and it is expected to provide some stimulus for the economy—although many of the tax cuts involve extending some key provisions that were set to expire soon. As long as the labor market remains stable, consumption should continue to support the U.S. economy with the additional tax-relief boost. Inflation has calmed down and continues to gradually ease toward normalcy, further contributing to healthy consumption.

Although the economic outlook has some positive aspects, risk continues to loom over the global economy and markets. The markets may have bounced back from the first round of the trade war, but that recovery could be based on the idea that the administration will always retract economic threats at the last minute. The risk of a highly damaging trade war remains a serious threat, which merits some caution throughout the remaining half of 2025. Reciprocal tariffs could eventually fade, but Trump and his administration can introduce other trade barriers as they deem necessary. Since the S&P 500 Index has recovered and reached new highs, the administration may opt for more stringent policies to achieve their goal of winning favorable trade terms.

Amidst the trade-war confusion, inflation remains a key theme impacting many areas. Some argue that tariffs are inflationary, while others maintain that they are only one time price increases. Both sides make valid points, and the actual impact would likely depend on the longevity of a trade war as well as how each trading partner handles the conflict. Prolonged tit-for-tat responses would likely have inflationary effects. These are considerations the Fed is likely weighing as the central bank plans and executes its monetary policies. Before the start of 2025, many had anticipated several interest-rate cuts from the Fed. However, Fed Chairman Powell and other voting members have yet to cut rates since their last cut in December 2024.

Inflation has come down, although the pace has leveled off.