Income Planning

As an experienced financial professional, you know how important it is to help clients design portfolios that address lasting income in retirement. However, you also know that the strategies you’ve put in place for clients could be jeopardized by events out of your control, such as longer life spans, market downturns, lower interest-rate environments, illness, and long-term care costs.

What if there was a way to help keep these factors from impacting your clients' retirement income?

Create Protected Lifetime Income, Not Just Lifetime Income

Outside of Social Security retirement benefits and pensions, annuities are the only way to provide protected lifetime income for your clients. When combined with an optional benefit for an additional cost, annuities also can help clients increase future retirement income. That income can be counted on whether markets are up or down. And while that's great news for your clients, it also means you're not continually searching for new income strategies as markets fluctuate.

Start by Determining Clients' Retirement Income Needs

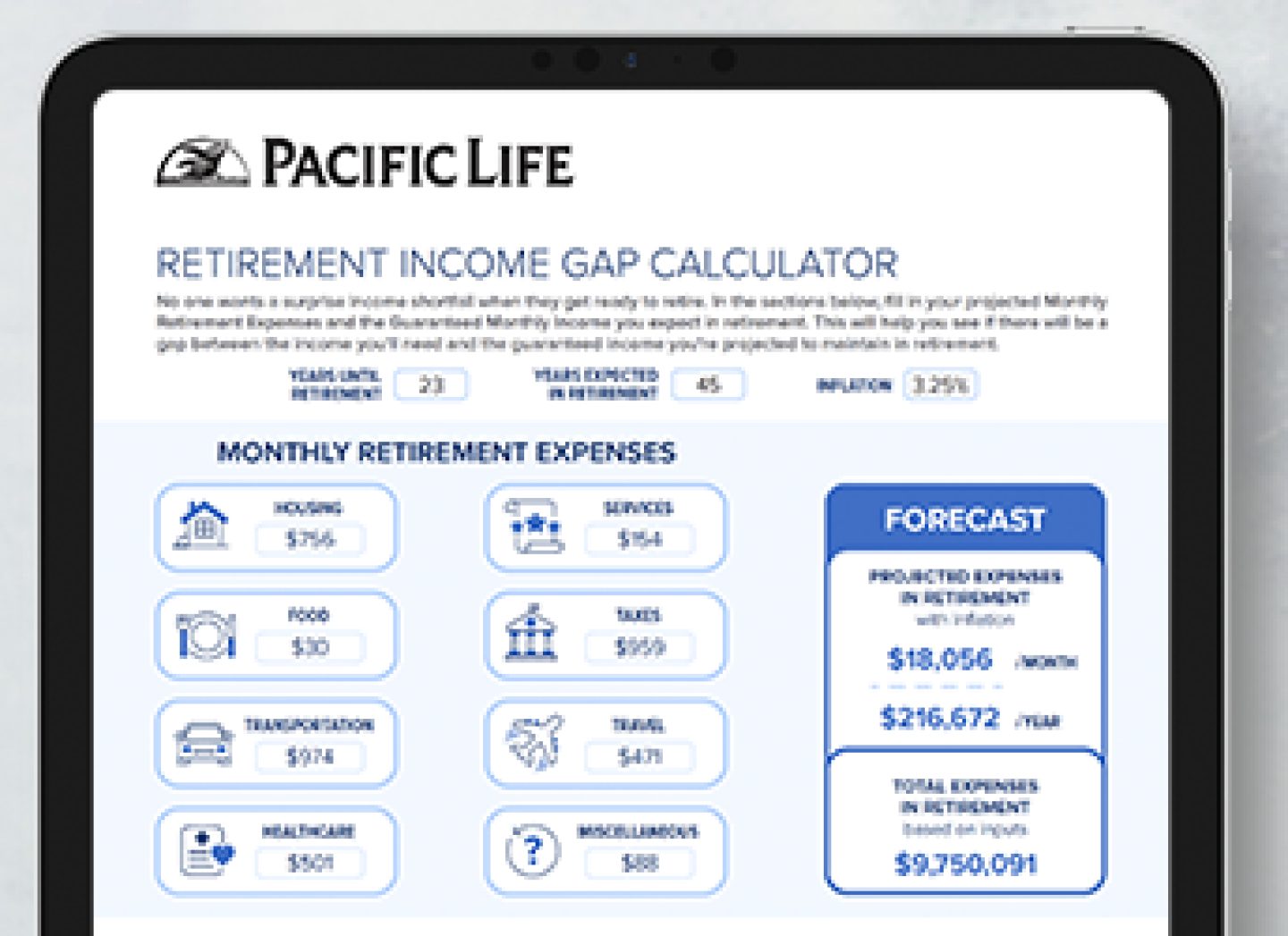

No one wants a surprise shortfall when it comes to the money they need in retirement. So, clients are counting on you to help ensure there won't be one. Our Retirement Income Gap Calculator is a simple, interactive way to help clients identify essential future expenses and expected sources of guaranteed money to expose any gaps in income needs. Clients with gaps may find that an annuity could be a way to help cover that shortage.

The Big Picture

In addition to helping clients ensure they have sources of protected lifetime income, creating a comprehensive retirement plan requires knowledge of a variety of planning resources and strategies. Explore the topics below.

Resources

Want to Talk Further on this Topic?

The Retirement Strategies Group, subject-matter specialists with advanced degrees and designations such as CFA®, CFP®, ChFC®, CLU®, and JD, are ready to help.

VLQ0955WP-2400

24-414

Insurance product and rider guarantees, including optional benefits and any fixed crediting rates or annuity payout rates, are backed by the financial strength and claims-paying ability of the issuing insurance company and do not protect the value of the variable investment options. They are not backed by the broker/dealer from which this annuity is purchased, by the insurance agency from which this annuity is purchased, or any affiliates of those entities, and none makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company.